View the complete slideshow at National Mortgage News

Despite consumer demand for housing remaining high, homebuyers' confidence in their ability to save enough for a down payment fell in the first quarter, with some feeling less positive than others.

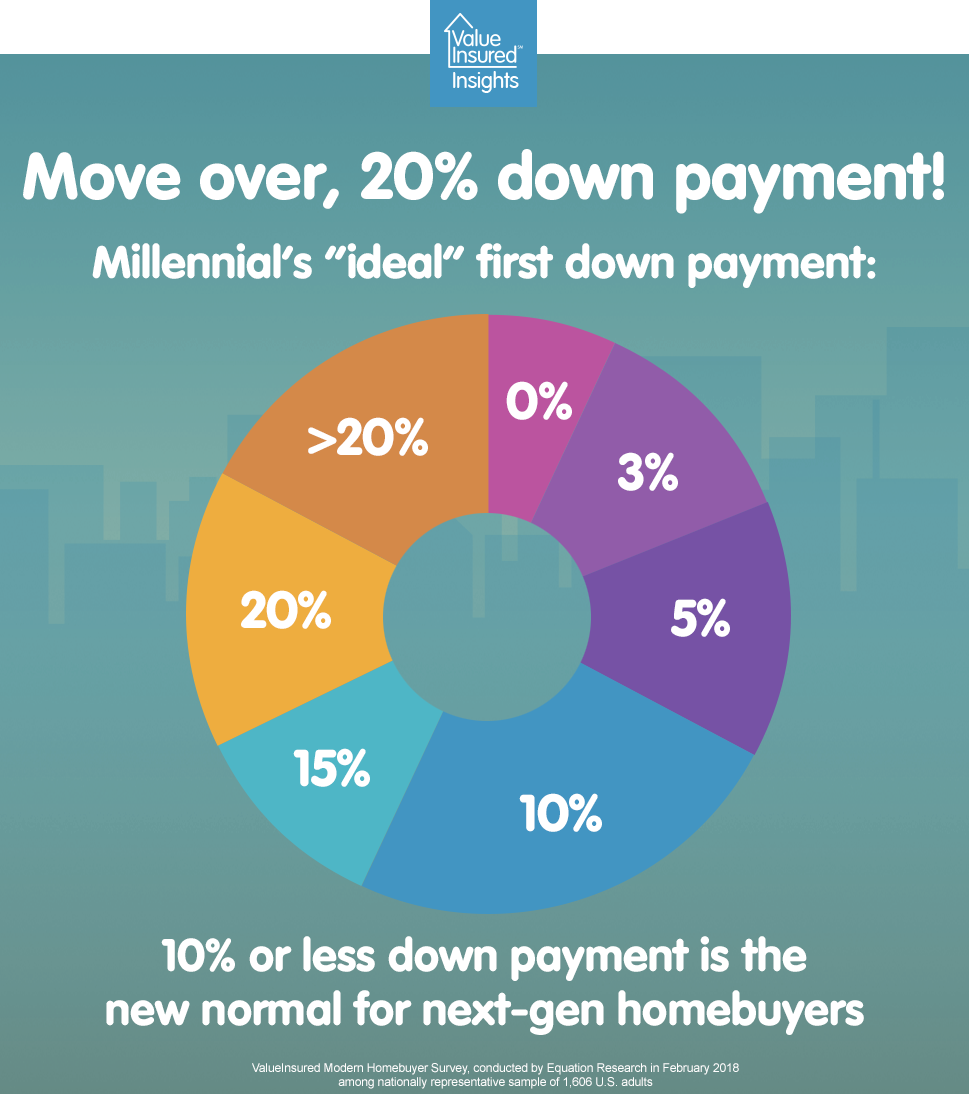

Millennials in particular saw declining confidence toward down payment affordability, with only 35% of millennial first-time homebuyers claiming they can afford a down payment, according to ValueInsured, a Dallas-based down payment insurance company. This is down nine percentage points from a year ago.