New Research from ValueInsured Reveals Differing Gender Attitudes Around Home Buying

NEW YORK, May 17, 2016–With spring home buying season in full swing, a new survey indicates women may be a harder sell than men. That’s an issue given that women are key decision-makers in home purchases.

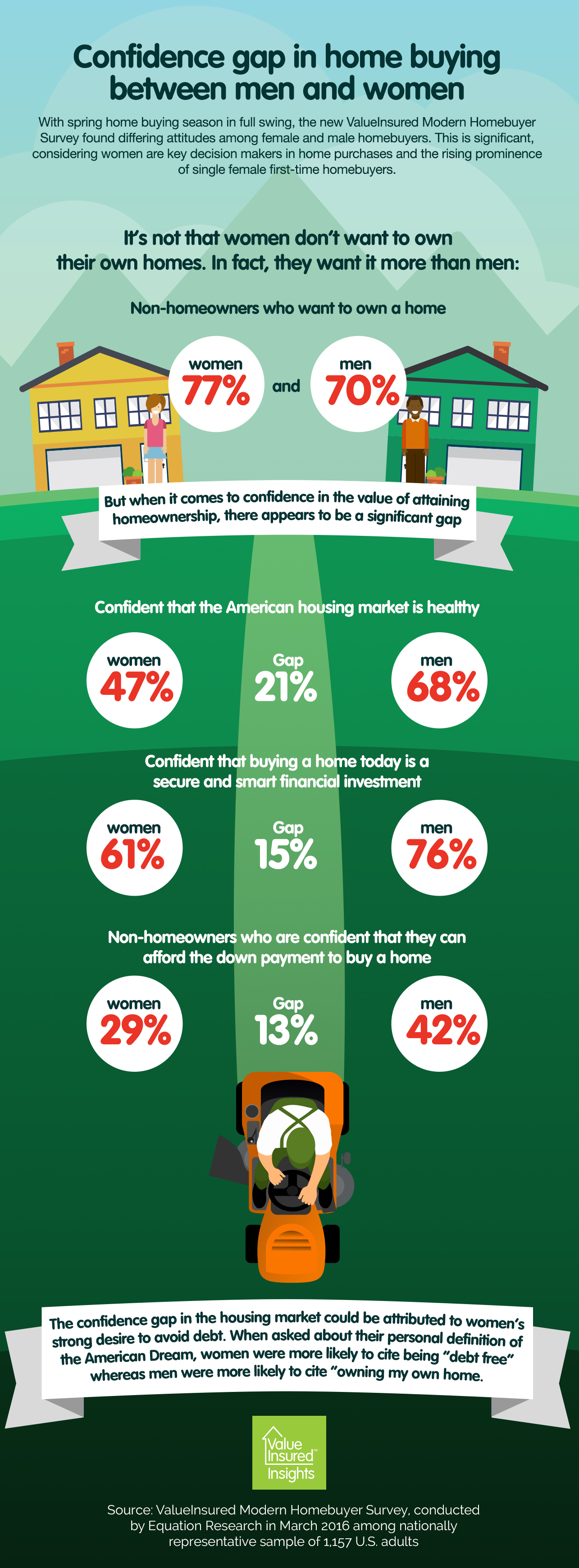

It is not that women don’t want to own their own homes. In fact, they want them more: according to the ValueInsured Modern Homebuyer Survey, 77 percent of women who don’t own a home say they would like to buy a home compared to just 70 percent of men. But when it comes to confidence in the value of attaining homeownership, there appears to be a significant confidence gap:

- Women are less confident that the American housing market is healthy, with a confidence gap of 21 percentage points (68 percent of men vs. 47 percent of women).

- Women are less confident that buying a home today is a secure and smart financial investment, with a confidence gap of 15 percentage points (76 percent of men vs. 61 percent of women).

- Women non-homeowners are less confident that they can afford the down payment to buy a home, with a confidence gap of 13 percentage points (42 percent of men vs. 29 percent of women)

Among homeowners, men are more confident than women that they can sell their home for the same amount or more than what they paid for it. In addition, more men (83 percent) than women (74 percent) would like to sell their current home and upgrade to a new one.

And for those interested in upgrading, women (69 percent) are less confident that they can afford the down payment on that new home than men (92 percent).

The housing confidence gap between genders could be attributed to women’s stronger desire to avoid debt. When asked about their personal definition of the American Dream, women were more likely to cite being “debt free” while men were more likely to cite “owning my own home.”

“Understanding these differences in attitudes will help make this year’s home buying season successful for both sellers and lenders,” said Joe Melendez, CEO of ValueInsured. “The numbers highlight the need to ensure that all buyers, and especially women, know about the new ways they can protect their hard-earned investments when buying a home.”

Research has long shown that women make the purchasing decision in 91 percent of homes. And their money talks: women’s incomes are rising, and they are graduating college at higher rates than men. So when it comes to this year’s home buying season, women are important consumers: in fact, with more single female than male homebuyers, pundits have recently predicted the return of the single female homebuyer.

One way all modern homebuyers can protect their investment is through down payment protection. +Plus by ValueInsured, now being offered with mortgages through participating financial institutions, is the only down payment protection program available to homebuyers today.

Survey Methodology

The ValueInsured Modern Homebuyer Survey was conducted online by Equation Research on behalf of ValueInsured in March 2016 among a nationally representative sample of 1,157 American adults ages 18 and older.