We know this is true: Americans have a strong desire to become homeowners (79% among non-homeowners, according to the latest ValueInsured Modern Homebuyer Survey) and the next generation continues to view homeownership as an important part of their American Dream (78% among millennials). However, increasing evidence shows they may not enjoy the process of actually buying a home.

Are 1 in 3 homebuyers in America now buying blind?

We admit it, this headline may be a bit sensational; but if you consider the latest homebuyer reports, it may not be that far-fetched after all.

In 2017, 35% of all homebuyers made an offer on a home sight unseen, according to a Redfin report. The fear of missing out in some hot housing markets seem to have turned more otherwise rational, responsible Americans into risky homebuyers. Throw in sales contracts that also waive home inspections in order to win bidding wars, then yes, in essence, a sizeable number of desperate homebuyers have now been reduced to pretty much buying blind.

But that’s not the whole story. The latest ValueInsured Modern Homebuyer Survey revealed that some homebuyers are also planning a purchase without having basic understanding of new tax laws, interest rate trends and how home value in the areas where they are shopping could potentially be affected.

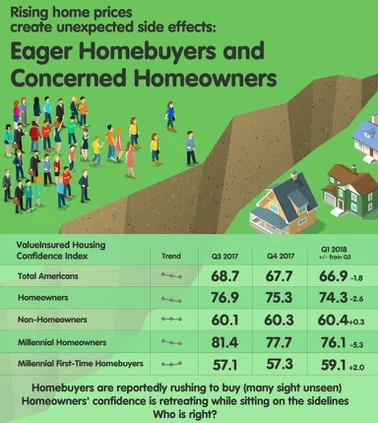

Confidence Among Homeowners, Homebuyers on Diverging Paths

DALLAS, March 6, 2018 – On the heels of the most recent Case-Shiller report, which again showed home prices on an upswing, ValueInsured’s latest quarterly Modern Homebuyer Survey finds that confidence among current American homeowners has decreased for two consecutive quarters and is starkly juxtaposed by an increase in new homebuyer confidence.