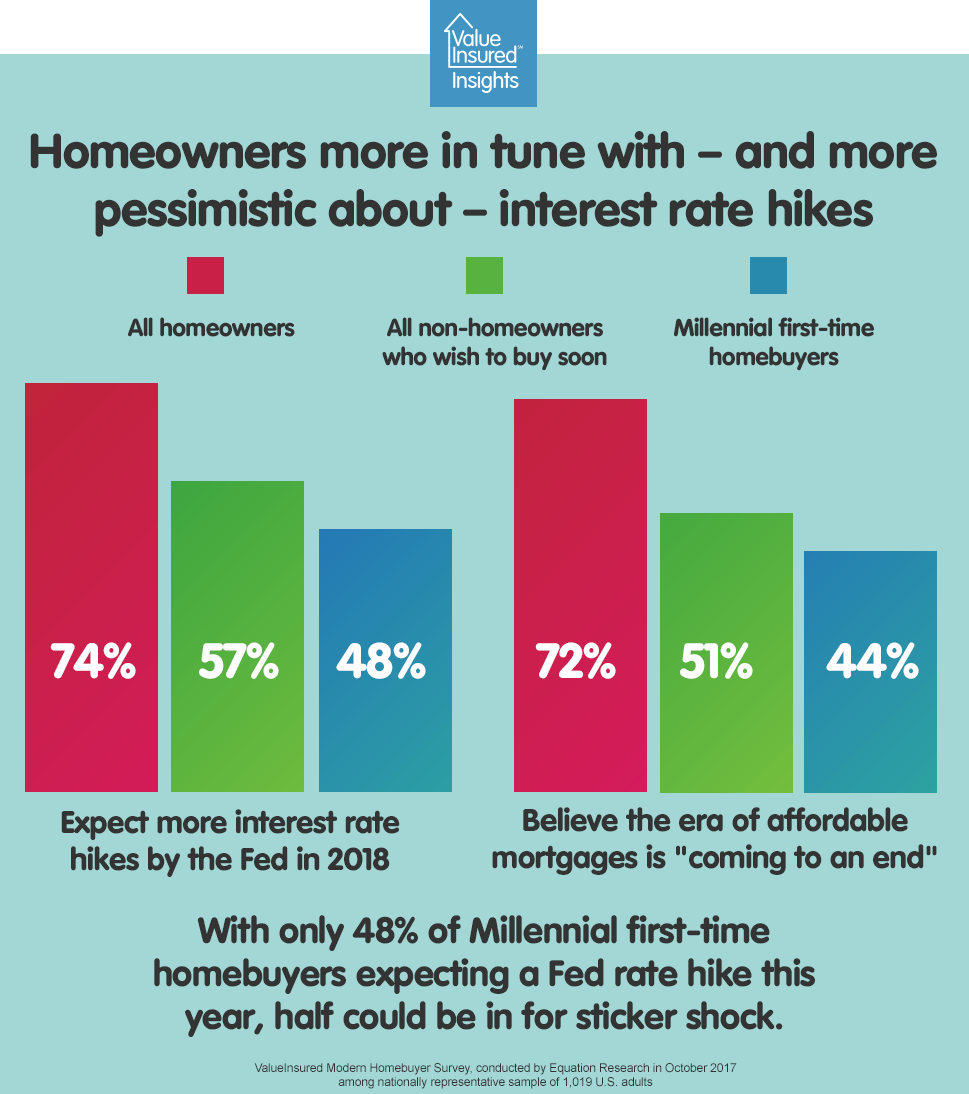

The general consensus is that interest rates are going up this year - perhaps quite a bit. Interestingly, this appears to be something existing homeowners are a lot more in tune with. One would think homeowner hopefuls – Americans who are in the market for a home and desire to buy in the near future – would also be more aware of upcoming rate increases, after all it could have certain implications on their budget and buying timeline. However, according to ValueInsured’s latest quarterly Modern Homebuyer Survey, non-homeowners who wish to buy in the next three year report to have a lower awareness of upcoming rate hikes, or they are more optimistic that a rate hike way not happen.

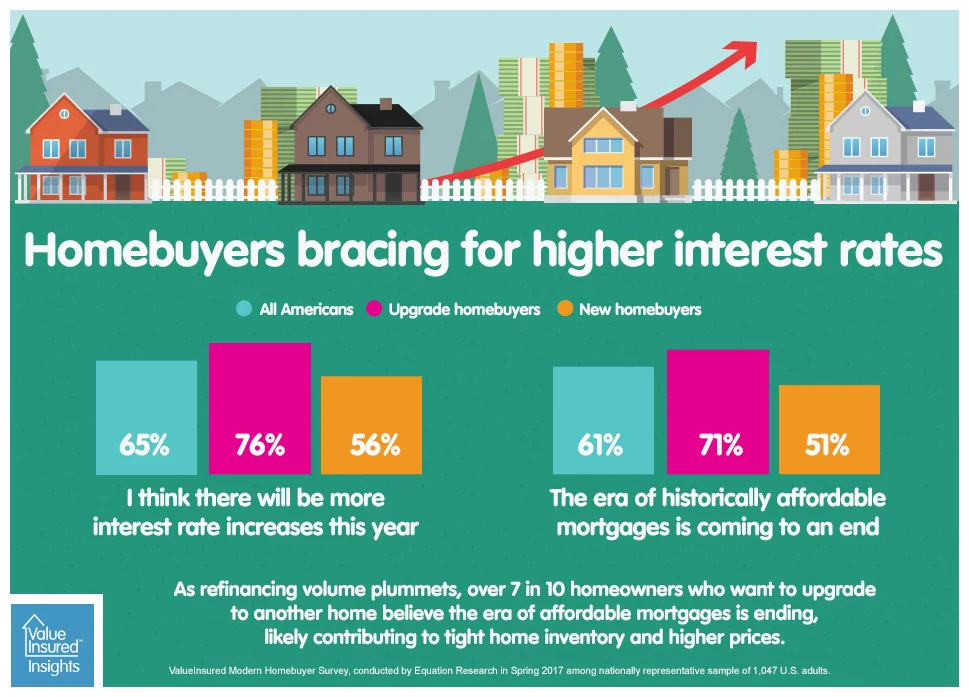

Homebuyers expect further interest rate hikes this year

Yesterday, the Federal Reserve increased its benchmark interest rate a quarter point to a new target range of 1% to 1.25%. It was a widely watched move as it reaffirms the Fed's confidence in the country’s economic growth and signals a continuous rate-hike trend after two recent increases.

In the latest ValueInsured quarterly Modern Homebuyer Survey conducted in Spring 2017, a nationally represented sample of Americans – including homeowners and renters who want to upgrade or to buy – were asked about their opinions and predictions on interest rate movements. The majority expects to see further rate increases this year: