Americans do not expect all home buying to come to a halt just because rates are moving higher. They recognize most will still want to pursue the American Dream of owning a home, despite higher rates being another barrier. Overall, just over half (53%) expect higher mortgage rates to lower buying demand in their local neighborhood, or to drive down buyers’ budget. Millennials, who are more price-sensitive and less averse to renting, tend to attribute more negative housing market impact to rising rates, while suburban homeowners tend to expect more muted impact in their neighborhood.

Rising mortgage rates feared most to trigger home value erosion

In the latest ValueInsured Modern Homebuyer Survey conducted in Summer 2018, 65% of all American homeowners believe the housing market is near its current cycle peak and 63% believe there will be a price correction in their area within two years – the highest levels recorded for both measures since the inception of the quarterly national survey in Spring 2016.

Given that similar correction concerns have been reported recently by The Washington Post, CNBC, Bloomberg, and Forbes, among many others, this declining homeowner confidence in home value sustainability is not news. What has not been examined more closely, however, are the potential catalysts for the pending correction.

The M Report: Will Rising Mortgage Rates Ruin the Homebuying Season?

Most homeowners believe that low mortgage rates are a thing of the past. The ValueInsured survey indicated that 72 percent of existing homeowners believed the era of historically low rates and affordable mortgages was coming to an end. This sentiment was particularly acute among homeowners of expensive homes, with 95 percent of those who reported owning a home valued at $1 million or more expecting the end of low mortgage rates in their lifetime.

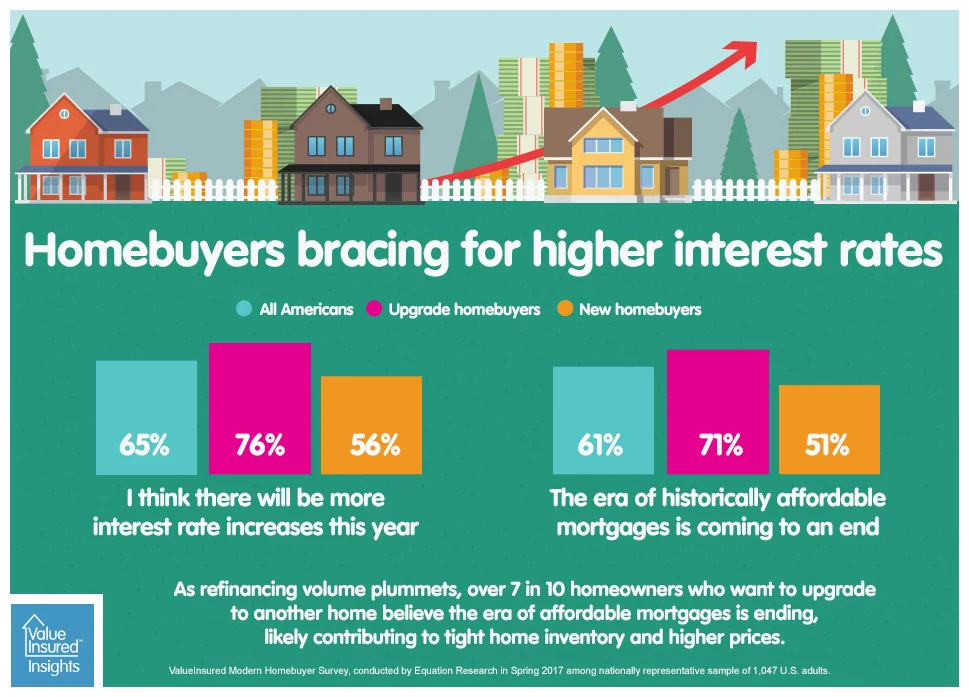

Homebuyers expect further interest rate hikes this year

Yesterday, the Federal Reserve increased its benchmark interest rate a quarter point to a new target range of 1% to 1.25%. It was a widely watched move as it reaffirms the Fed's confidence in the country’s economic growth and signals a continuous rate-hike trend after two recent increases.

In the latest ValueInsured quarterly Modern Homebuyer Survey conducted in Spring 2017, a nationally represented sample of Americans – including homeowners and renters who want to upgrade or to buy – were asked about their opinions and predictions on interest rate movements. The majority expects to see further rate increases this year:

The Mortgage Reports - What’s With Mortgage Rates? Experts Offer Predictions For The Remainder of 2017

As seen on The Mortgage Reports

Mortgage Rates: The Ups And Downs

Thinking hard about buying a home? You’re likely keeping a close eye on mortgage rates, which in part determine how much home you can afford. After all, when rates go up, purchasing power goes down.

The good news is that mortgage rates remain close to historical lows. The not-so-good news is that many expect rates to be higher by the end of 2017. But it’s impossible to accurately predict rates. And a lot can change between now and the end of the year. Government policies, market conditions, world events and other issues can cause rates to rise or fall.

To get a better feel for where rates may be headed over the next nine months, I asked a group of industry experts to assess the current rate climate and chime in with their predictions.