It’s official: we’re in a seller’s housing market. The clues certainly were not subtle. First there was the declaration that this is "the strongest seller's market ever", that home inventory is at historic low as sellers hold on to their homes and refuse to sell. We even learned it has become standard practice for buyers in hot housing markets to waive home inspection and other contingencies in their offers, while participating in heated bidding wars. A seller’s market appears to be the new normal, but will it last?

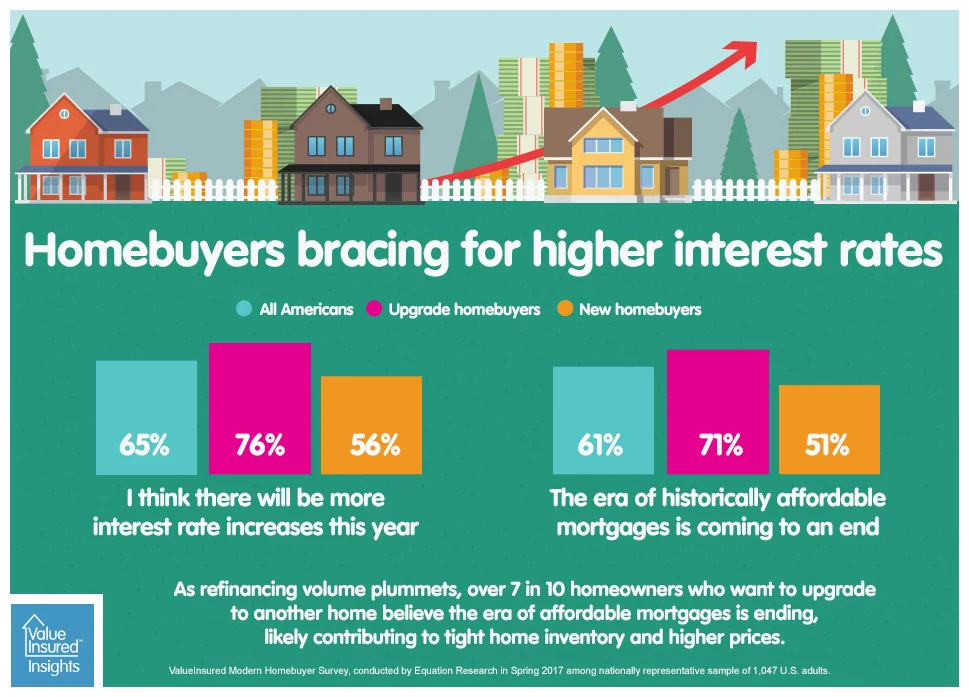

Homebuyers expect further interest rate hikes this year

Yesterday, the Federal Reserve increased its benchmark interest rate a quarter point to a new target range of 1% to 1.25%. It was a widely watched move as it reaffirms the Fed's confidence in the country’s economic growth and signals a continuous rate-hike trend after two recent increases.

In the latest ValueInsured quarterly Modern Homebuyer Survey conducted in Spring 2017, a nationally represented sample of Americans – including homeowners and renters who want to upgrade or to buy – were asked about their opinions and predictions on interest rate movements. The majority expects to see further rate increases this year:

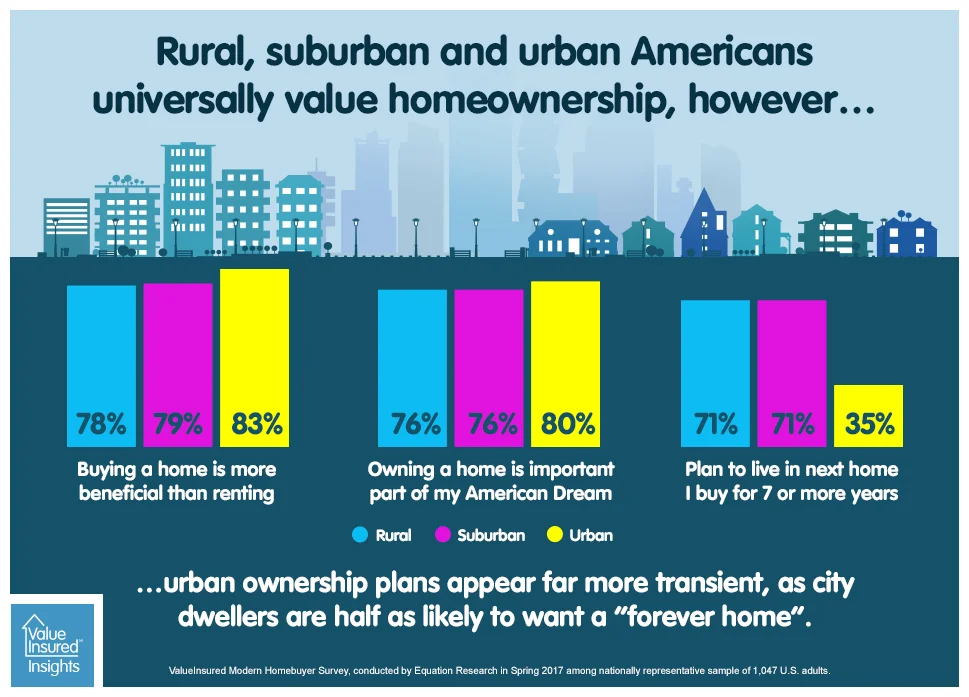

Rural-Urban Divide is real in America, at least when it comes to home buying – conclusion of a 3-part series

We certainly gave away the big reveal in the headline above, but it’s hard not to, especially after evidence from the past two weeks in our 3-part series. There has been much discussion since the recent presidential election on how Americans may endear to different or similar beliefs depending on where they reside along the municipal line. We can say when it comes to homeownership and buying attitudes, the pattern of differences seems real.

Rural-Urban divide among American homeowners? Part 1 of a 3-part series

Dubbed the great American "Rural-Urban Divide", or an "Urban-Rural Divide" sometimes when reported by writers from urban areas, there has been a lot of talk about the differences that set Americans from different locales apart. Our analysts and writers are less interested in politics, but we are curious about differences in ideals and motivations that drive American homebuyers, so we can learn to better serve and empower them.

More experience, and with deeper pockets

According to NAR, over 65% of all U.S. homes sold in 2016 went to repeat homebuyers. So why do we constantly see more spotlights on first-time homebuyers? For starters (no pun intended), the decline in overall homeownership rate has been largely attributed to first-time homebuyers, whose share of total buyers dropped to a near-30 year low in 2014. Secondly, it is presumed, rightly so, that the entrance of first-time buyers helps expand the overall U.S. housing market, as buyers typically don’t go back to renting by choice once they have owned their first home.

However, as the industry encourages more first-time buyers to convert to homeownership, it is important to remember that without repeat homebuyers who upgrade to bigger, more expensive homes, starter home inventory cannot be freed up for first-time buyers, and the market size would stay stagnant. It has been reported that home sales this Spring has been slowed by low inventory; and one key reason for the shortage is would-be sellers holding onto their current homes, concerned that they may not be able to find desirable homes to upgrade to. In other words, it is not far-fetched to say that not only are repeat buyers responsible for two-thirds of all home sales, they have a hand in helping close the other one-third as well.

HousingWire - Here are 5 bold predictions for housing in 2017 .... Plus, a bonus

As originally appeared in HousingWire

At this time last year, I predicted 2016 would be a good year to buy a home. It appears millions of Americans agreed with me. Total home sales were up 5% in the first half of 2016, and the total annual growth is expected to cap off at 4.7%. Most encouraging is the record 34% first-time homebuyers in Q3 2016, up from 29% in 2015.

For 2017, I predict a softening led by the imminent rates hikes – Fed supported or not. But there still could be opportunities for buyers and sellers alike.

Not yet in their forever home, Millennial homeowners are ripe for upgrading

Unlike their parents or grandparents, Millennials do not plan to live in the same house for 40 years.

One reason is likely due to a change in personal ideals and mindset. According to the latest ValueInsured Modern Homebuyer Survey, while “owning my own home” remains – just like for their parents – the top personal definition of the American Dream for Millennials, two other popular answers are “having the freedom to pursue opportunities wherever they are” and “being able to move and live wherever I want”.

A second – and related – factor is the reality of the modern job market. According to the latest U.S. Census Bureau data, the average job tenure of a Millennial is 3.0 years, and more than 1 in 5 Millennials moved in 2015.

A third reason ...

Huffington Post - The True State of Housing

As originally appeared on Huffington Post

Despite historically low interest rates and historically high housing prices, the true state of housing can be summed up in a one word: stagnant. It’s status quo. It’s a boring subject. Yet housing remains one of the largest economic drivers in our country accounting for over $1.2T in sales. It’s massive and massively important.