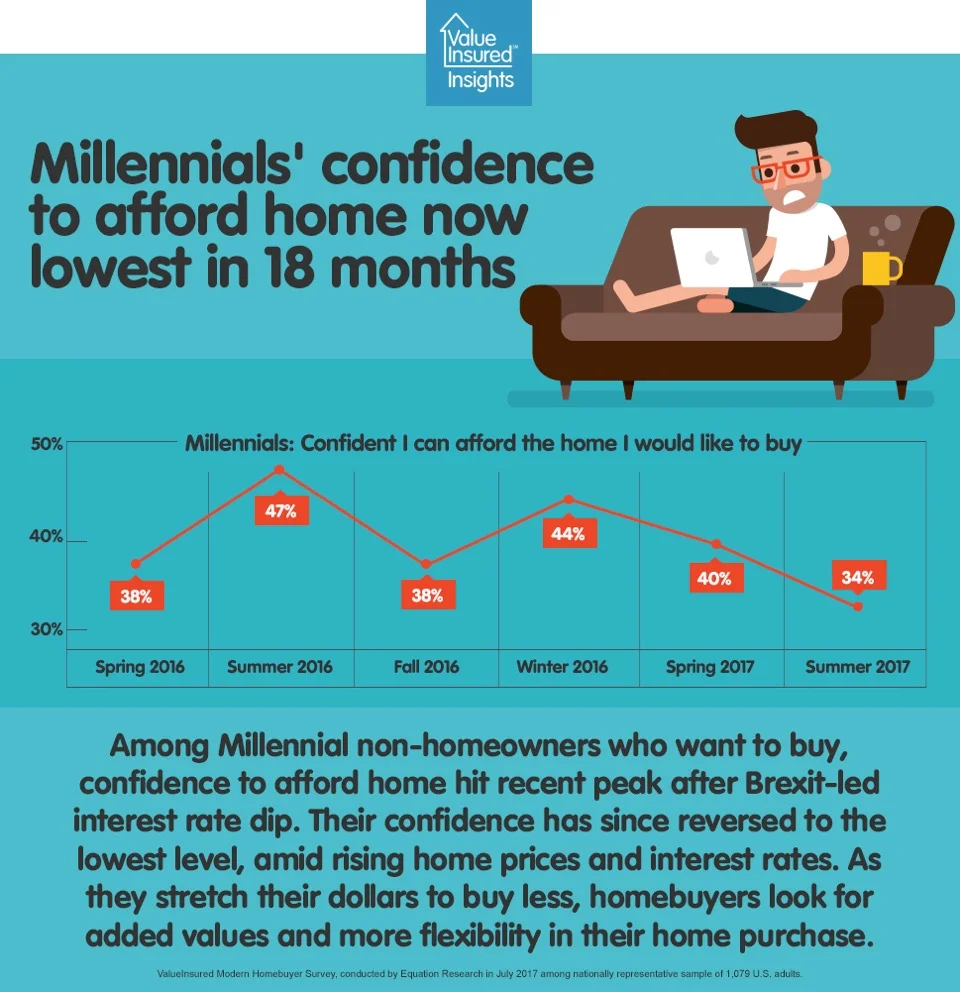

Affordability is by far the biggest barrier to homeownership for Millennials. This fiscally conservative generation is looking for greater value and flexibility from their dollar in everything they do - including housing. Through ValueInsured’s quarterly survey, we learned that even among Millennial non-homeowners who express an interest in buying a home “in the next few year”, the confidence that they could actually afford one they would like to buy continues to hover below 50%.

Rising sea levels vs economics…American homebuyers share their biggest external risk factors

Millennials’ credit may be ready for home buying, but are their stomachs ready?

According to ValueInsured’s latest quarterly Modern Homebuyer Survey conducted in Spring 2017, 8 in 10 (81%) Millennial renters would like to buy a home, and 74% would like to buy “now” if they could afford to. So it’s certainly not a desire issue. However, affordability challenges aside, Millennials seem to lack the confidence that buying a home now is a sound decision.

Regret the lunch you ate today? Many Americans regret buying their home.

According to a latest Trulia survey conducted in June 2017, 44% of all Americans regret their real estate decisions. An overwhelming 71% Millennials surveyed say they have regrets about the home they chose or the process of getting their current home. Why and what can we do about it?

Quick Update on Canada

We wondered about the future of the red hot Toronto market 4 weeks ago when discussing the longevity of a seller’s market, it appears now we are starting to see some answers. The just-released June housing report indicates a rather dramatic sharp turn for Toronto, which has now been dubbed “officially a buyer’s market”. May to June monthly decline was largest since 2010, sales volume to listing volume ratio is now at 1:2.5, and Toronto’s sales is now 42% down from the March 2017 peak. An interesting case study no doubt for how quickly a market can turn hot and then ice cold again with not much warning. Something to keep an eye on.

Rising home prices? This is how you deal if you’re a Millennial.

Happy Birthday, America!

Overall, 7 in 10 Americans (71%) – and 70% Millennials – say keeping the American Dream alive is important to them. 66% of all Americans and 69% of Millennials also say it is important to them that the American Dream stays relevant for their children and for future generations. However, there seems to be a consensus that the American Dream cannot become stagnant, and it must evolve to stay meaningful...

Home prices keep going up, so are concerns

Have we entered a new territory where it’s boring to talk about records yet? It seems when it comes to the housing sector, every week a new record is broken: fewest days on market…check; lowest inventory…check; highest average sales price…check. Last week, the median existing home sales price at the national level was reported to have hit an all-time high of $252,800 in May. Median number of days for a home on the market is now 27 days, the shortest since tracking began. For-sale home supply now sits at 2.7 months, again – you guess it – a new record.

As home prices continue to heat up in many parts of the country, consumer jitters and unease also seem to be higher...