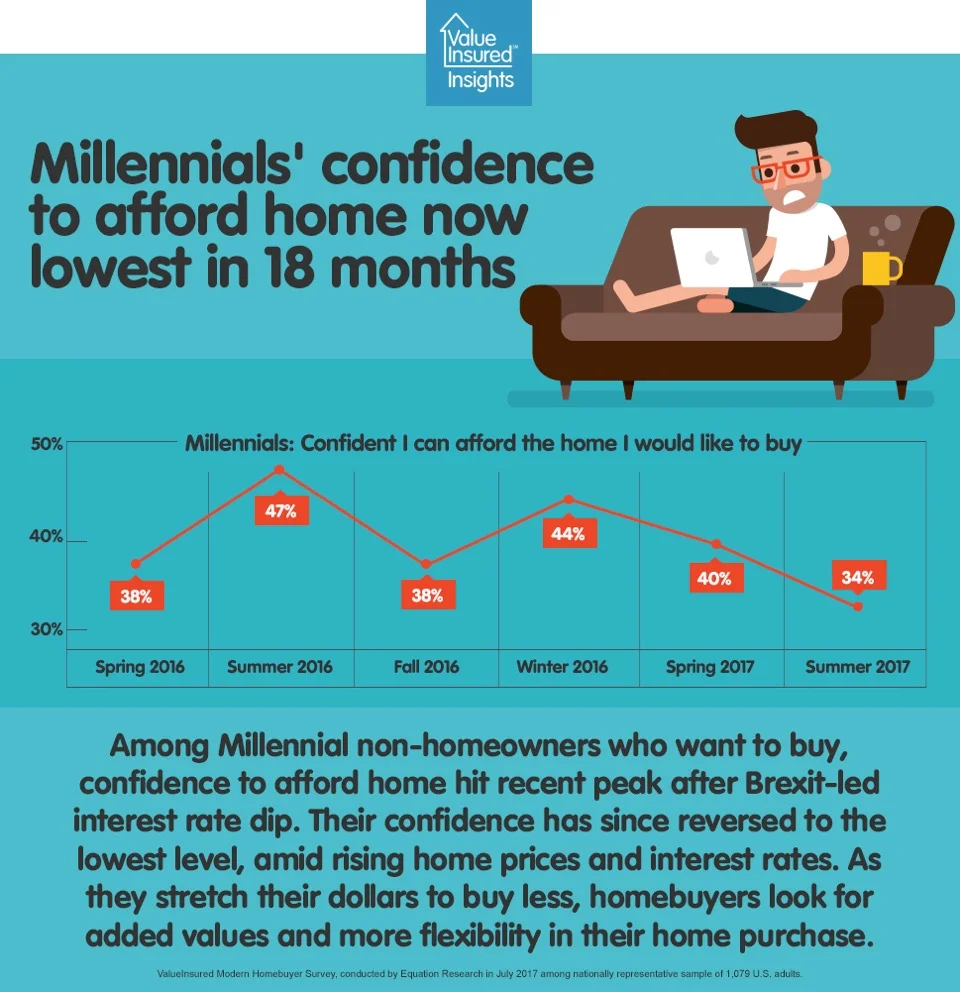

Millennials’ housing confidence and enthusiasm plummet to record low in latest ValueInsured Modern Homebuyer Survey

DALLAS, August 15, 2018 – Millennials’ perceived value in buying a home dropped below 50 percent, down significantly from post-Brexit high, according to the latest ValueInsured quarterly Modern Homebuyer Survey