In a recent interview with CNBC regarding the current housing market and homeownership rate, a self-made millionaire and published financial author made the claim that an average homeowner in American today is 38 times wealthier than the average renter. This has what many often call the American Dream – if you have made it in this greatest country in the world, you get to own a piece of its land.

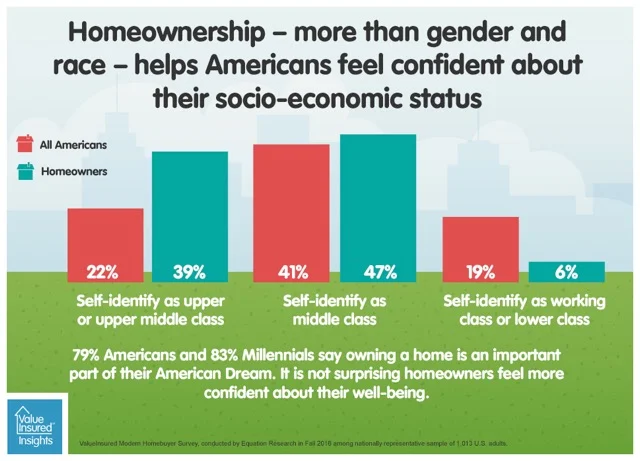

But in recent years, since the housing crisis, this notion has been challenged, and some of the people who have fared most poorly and had the toughest time surviving the financial crisis were Americans who owned homes in 2007-2008. We wanted to know how today’s Americans feel about their wellbeing and how it relates to homeownership, and designed part of our latest ValueInsured Modern Homebuyer Survey to explore exactly that.