Earlier this week, a “rare bear” who caught national attention by accurately predicting the last housing crash in 2005 returned to the headlines. The famed money manager sounded the alarm that current housing "valuation extreme" looks a lot like it is 2005 all over. And he used the b-word, cautioning homebuyers are again in denial of a bubble just as they did before 2007.

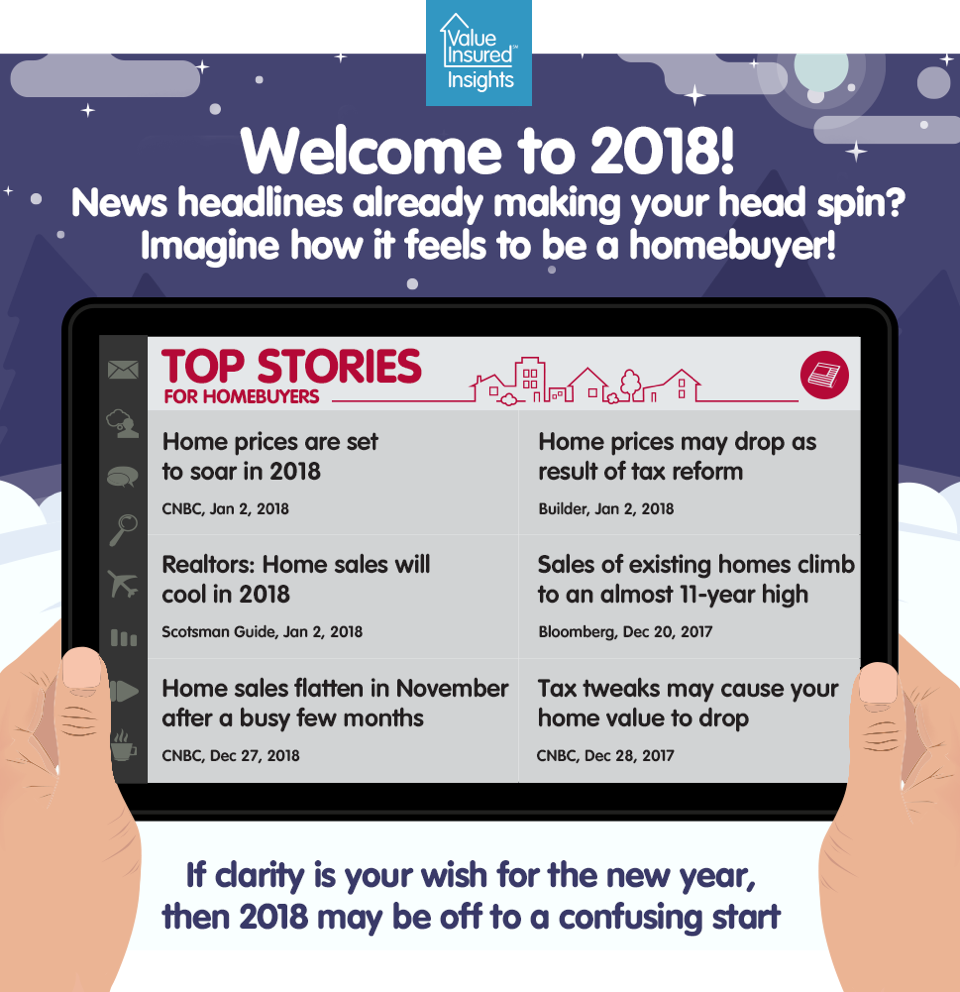

There are no doubt both many bear and bull economists right now, each with their own opinions on the subject. But, to the non-economist homebuyers, this is all just more conflicting noise that impacts their confidence and decision making.