Credit risk transfer (CRT) or sharing is the process in which the government-sponsored enterprises bundle up the mortgages they buy from lenders and sell a portion of the risk to private investors. Instead of the GSEs shouldering the loan risk alone, selected investors help offset any potential risk from loan defaults. CRT began as a test in 2012 and is now quickly ramping up as investor interest and governmental oversight grows. Governmental oversight makes sense—we don’t want another 2007. But why are more investors becoming so interested in CRT?

As California goes, so goes the nation?

It has been said that when it comes to housing, the West leads the way. California has been ahead of the recent years’ real estate market run-up, and has garnered international attention for its jaw-dropping home prices. The Golden State enjoys the trifecta of being the most populated state in the nation, one of the most affluent with robust growth industries, and having the unique climate and geographical advantages that continue to make the state appealing to potential homeowners.

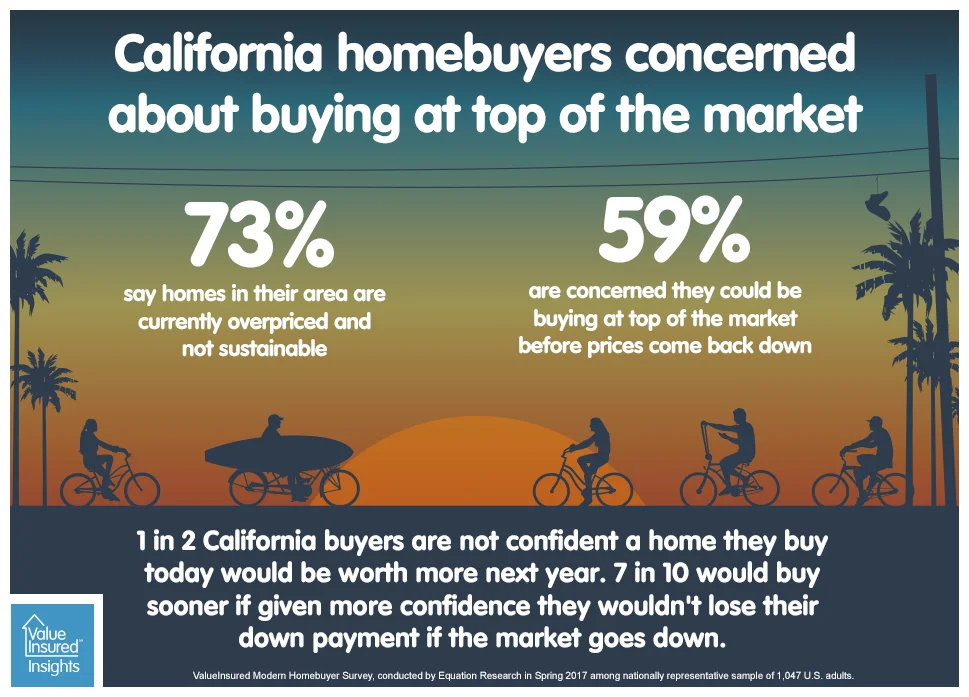

In the latest ValueInsured Modern Homebuyer Survey, conducted in April 2017, California homeowners and buyers seem to express apprehension and caution concerning the housing market..

More experience, and with deeper pockets

According to NAR, over 65% of all U.S. homes sold in 2016 went to repeat homebuyers. So why do we constantly see more spotlights on first-time homebuyers? For starters (no pun intended), the decline in overall homeownership rate has been largely attributed to first-time homebuyers, whose share of total buyers dropped to a near-30 year low in 2014. Secondly, it is presumed, rightly so, that the entrance of first-time buyers helps expand the overall U.S. housing market, as buyers typically don’t go back to renting by choice once they have owned their first home.

However, as the industry encourages more first-time buyers to convert to homeownership, it is important to remember that without repeat homebuyers who upgrade to bigger, more expensive homes, starter home inventory cannot be freed up for first-time buyers, and the market size would stay stagnant. It has been reported that home sales this Spring has been slowed by low inventory; and one key reason for the shortage is would-be sellers holding onto their current homes, concerned that they may not be able to find desirable homes to upgrade to. In other words, it is not far-fetched to say that not only are repeat buyers responsible for two-thirds of all home sales, they have a hand in helping close the other one-third as well.

The M Report - Confidence In Housing Steady, but Shaking

As originally seen on The M Report

Author: Scott Morgan in Daily Dose, Data, News

Americans remained as confident in the U.S. housing market as they have been, but this cautious optimism may be on shaky ground. That, at least, is the conclusion of ValueInsured’s quarterly Modern Homebuyer Survey, released Thursday.

The survey index ended Q1 at 67.7 out of 100, which was down less than 1 percentage point from Q4. According to the index, the so-called Trump bump “has plateaued after two interest rate increases in three months.”

Housing Confidence Index Remains Steady, Though Cautions Loom

Americans Still Value Homeownership and Want to Buy, According to ValueInsured’s Modern Homebuyer Survey

DALLAS, May 3, 2017 – Americans remain generally confident in the country’s housing market and the value of homeownership despite recent interest rate hikes, according to ValueInsured’s quarterly Modern Homebuyer Survey.

The survey produced an overall ValueInsured Housing Confidence Index score of 67.7 on a hundred-point scale, down less than one percentage point from January. The index is the aggregate mean of seven multidimensional confidence measures collected through the survey.

Mortgage Professional America - Mortgage product boosts buying in Mid-Atlantic market

As originally seen on Mortgage Professional America

by Anna Sobrevinas - 02 May 2017

Home purchases in the Mid-Atlantic markets of Maryland, Virginia and North Carolina are seeing a boost, thanks to First Heritage Mortgage’s Mortgage +Plus, according to a news release.

Mortgage +Plus, a down payment protection program, covers all FHA loan borrowers and is provided by First Heritage at no additional cost.

Omaha World-Herald - The young American dream

As appeared on Inspired Living Omaha / Omaha World-Herald

By Erik J. Martin/CTW Features

Don’t believe the hype: contrary to popular belief, the vast majority of Generation Y, better known as millennials, want to own a home — and most actually do, new data suggests. That’s good news for boomerang parents whose twenty-something-aged offspring moved back home in recent years due to the economic downturn.

Down Payment Protection Sees Traction in Mid-Atlantic Market

Loan officers see Mortgage +Plus℠ with down payment protection as key differentiator.

DALLAS, TX (PRWEB) APRIL 28, 2017

After a launching in January, First Heritage Mortgage’s new Mortgage +Plus℠ program is seeing significant growth heading into the Spring buying season. As the only mortgage company to offer loans with down payment protection in the Maryland, Virginia and North Carolina markets, First Heritage Mortgage remains focused on delivering positive, pro-homebuyer down payment protection solutions within its fast-paced mortgage service area.

“As home prices and competition across the Mid-Atlantic continue to heat up, we find that many potential borrowers are seeking greater confidence in the home buying process,” said Scott Kinne, Vice President, First Heritage Mortgage. “If home prices do become volatile, having peace of mind in knowing that their down payment can be protected is a game changer.”