Pacific Union Financial LLC recently announced that it is extending the PacificPlus offering to its Correspondent channel. PacificPlus is an innovative mortgage program that protects a homebuyer's down payment. Pacific Union's Retail and Wholesale channels already offer PacificPlus, so the addition of the Correspondent channel makes it available across all Pacific Union sales channels.

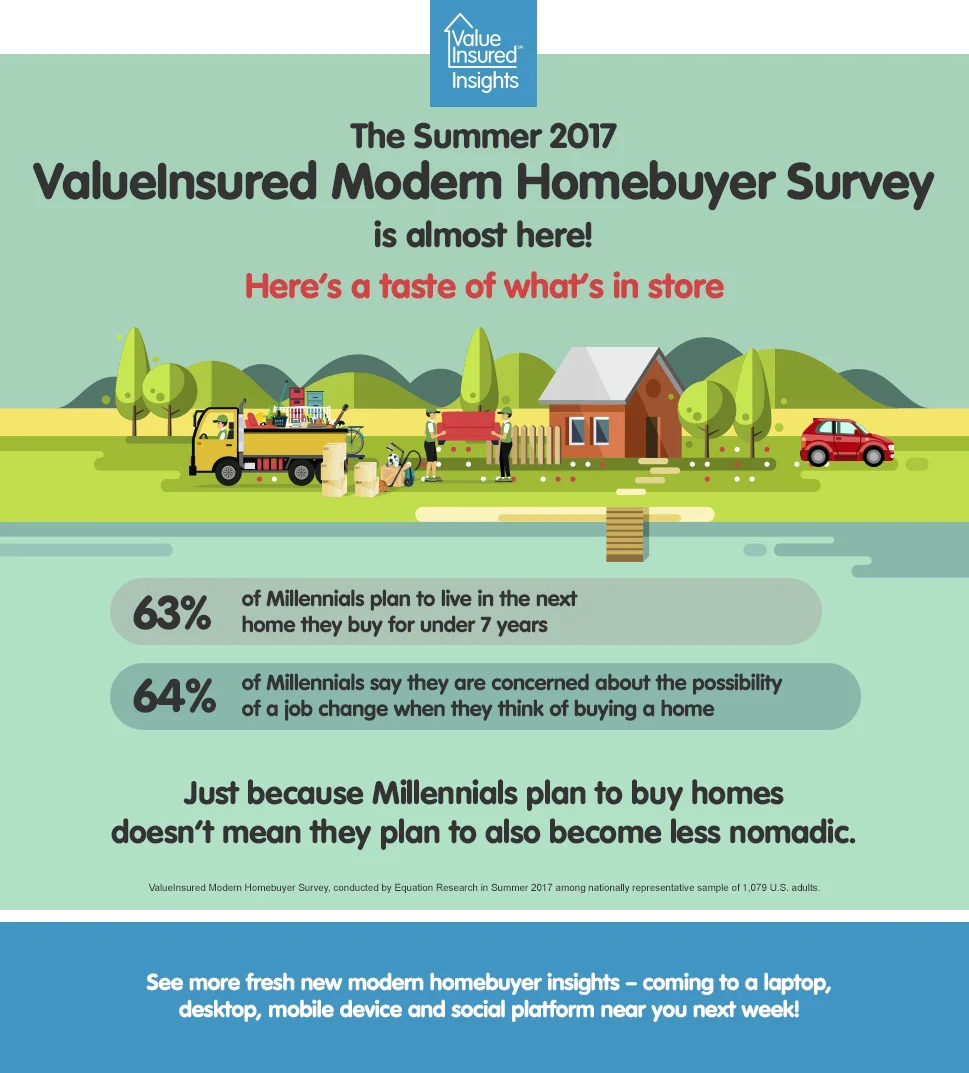

Summer Modern Homebuyer survey results almost here - Here's a taste

Millennials’ credit may be ready for home buying, but are their stomachs ready?

According to ValueInsured’s latest quarterly Modern Homebuyer Survey conducted in Spring 2017, 8 in 10 (81%) Millennial renters would like to buy a home, and 74% would like to buy “now” if they could afford to. So it’s certainly not a desire issue. However, affordability challenges aside, Millennials seem to lack the confidence that buying a home now is a sound decision.

Pacific Union Financial expands PacificPlus into Correspondent channel

Insurance covers homebuyers’ mortgage down payments

Pacific Union Financial and ValueInsured have announced the launch of PacificPlus, a new mortgage product that protects a homebuyer’s down payment.

PacificPlus features ValueInsured’s +Plus down payment protection embedded into loans offered by Pacific Union Financial. The PacificPlus program enables homebuyers to safeguard their down payment and purchase, even if they need to move and real estate market values are down when they sell. The program provides coverage up to the full amount of their down payment and, if all program requirements are met, reimburses any potential losses.

Regret the lunch you ate today? Many Americans regret buying their home.

According to a latest Trulia survey conducted in June 2017, 44% of all Americans regret their real estate decisions. An overwhelming 71% Millennials surveyed say they have regrets about the home they chose or the process of getting their current home. Why and what can we do about it?

Quick Update on Canada

We wondered about the future of the red hot Toronto market 4 weeks ago when discussing the longevity of a seller’s market, it appears now we are starting to see some answers. The just-released June housing report indicates a rather dramatic sharp turn for Toronto, which has now been dubbed “officially a buyer’s market”. May to June monthly decline was largest since 2010, sales volume to listing volume ratio is now at 1:2.5, and Toronto’s sales is now 42% down from the March 2017 peak. An interesting case study no doubt for how quickly a market can turn hot and then ice cold again with not much warning. Something to keep an eye on.

Rising home prices? This is how you deal if you’re a Millennial.

Happy Birthday, America!

Overall, 7 in 10 Americans (71%) – and 70% Millennials – say keeping the American Dream alive is important to them. 66% of all Americans and 69% of Millennials also say it is important to them that the American Dream stays relevant for their children and for future generations. However, there seems to be a consensus that the American Dream cannot become stagnant, and it must evolve to stay meaningful...