Keith Mestrich, President & CEO of Amalgamated Bank

This may come as a surprise to you, but I’m not a Millennial. I do know a few people, though, who fall into this huge group that is now coming of age. One question I often see in the media or hear in private discussion is, “why won’t these kids settle down and buy homes? Don’t they want to live the American Dream?”

To that question, there’s a simple answer: of course they do. But if you grew up during the 2008 housing crisis, how comfortable would you be buying a home?

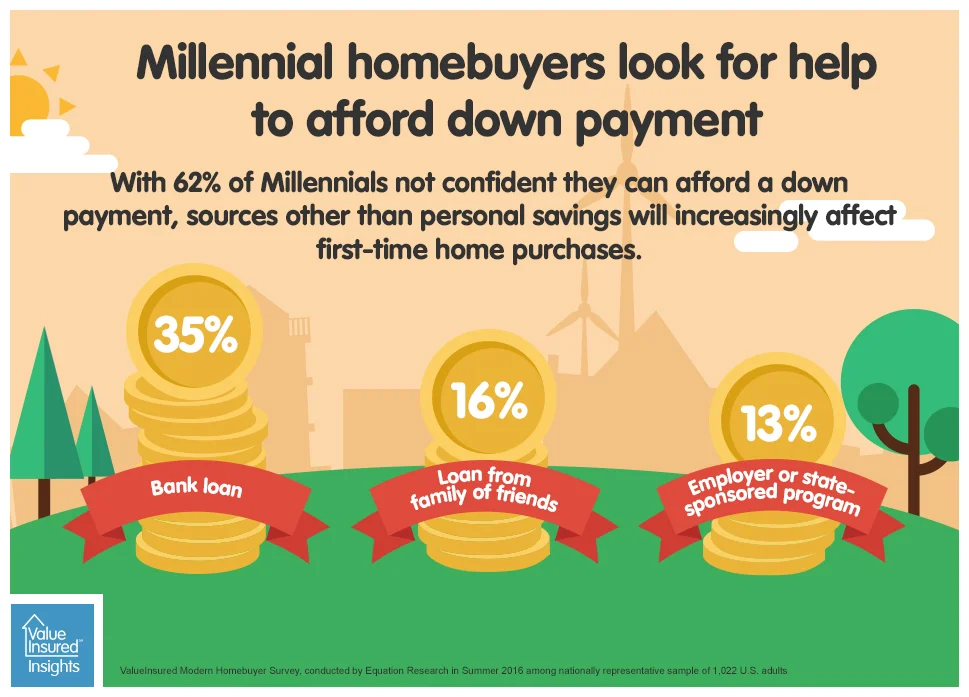

For most people, the down payment on a house is the single largest check they’ll ever write. That comes with an understandable level of anxiety. A recent Harris poll found that only 38% of Millennial non-homeowners have the confidence they can afford a down payment to buy a home. What happens, the rest wonder, if the market shrinks again? Buying a home is a lifestyle decision, but it’s also an enormous investment.

Around the time of the crash last decade, some economists started suggesting a novel approach. Banks that give out mortgages back up their risk with insurance, so why shouldn’t homebuyers do the same? Down payment protection is an idea that makes a lot of sense — you buy a home, and if within a few years you have to sell it at a loss due to market factors beyond your control, your insurance covers the difference. When 60% of non-homeowners say they believe buying a home is the best financial investment they can make for themselves and their family, why shouldn’t we make it as safe and easy as possible?

Amalgamated Bank recently launched a new project with a company called ValueInsured to offer the first commercially available down payment protection. For qualified first time homebuyers, we’re even offering it for free. This isn’t about just one bank or one company or one product, though. A full two-thirds of non-homeowners believe owning a home is an important part of the American Dream, and I agree with them. This kind of offering should become standard at any mortgage-granting institution, so people can buy with confidence and keep our economy on the right track.

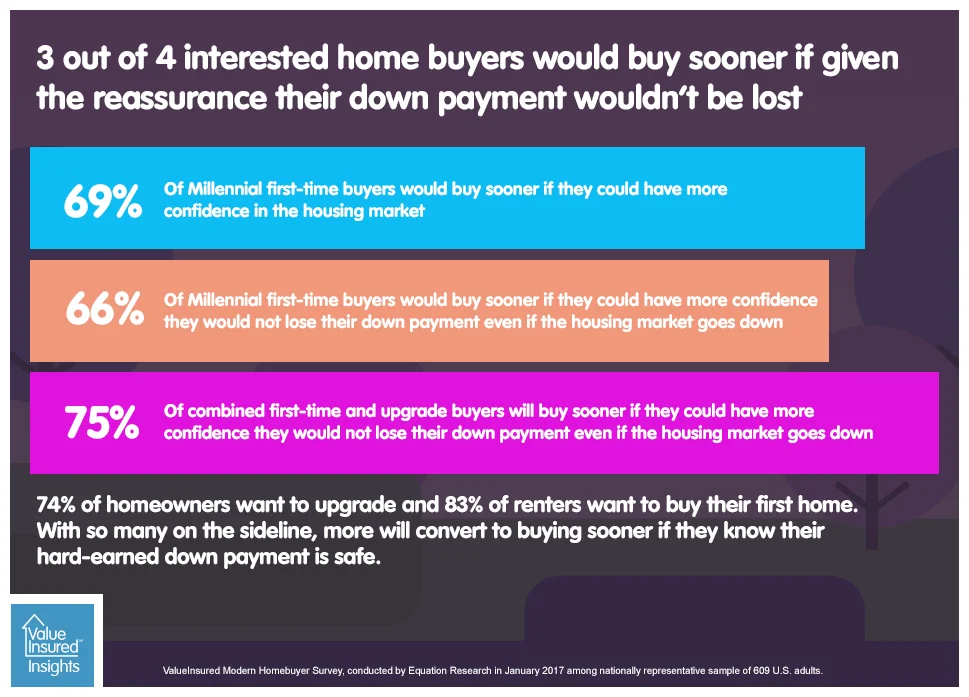

Going back to 2004, the homeownership rate has fallen for 11 consecutive years. The residential housing sector is an important indicator of the strength of our middle class. As the economy has improved over the last few years, some have wondered whether it’s getting better for everyone, or just the richest Americans. I believe that an economy where an estimated 19 million households of current non-homeowners say they would potentially buy sooner if they could have more confidence in the housing market is an economy with a lot of room left to grow.

It’s not that young people don’t want to buy homes — far from it. The specter of 2008 hangs over everyone, though, and Millennials can’t be faulted for their hesitancy. We need to make it safer to buy a home, so our economy can work for everyone — not just people with huge Wall Street portfolios. That’s the American Dream.