Forecasts on their massive influence aside, is the housing industry ready for this next generation of homebuyers? Just as Millennials are different moviegoers than their parents, they will be different homebuyers. One of the starkest differences: Millennials shop for their homes differently. According to the National Association of Realtors, 99% of Millennials search online when shopping for a home. They are twice as likely as their parents’ generation to use a mobile device to look for a home. In fact, nearly 6 in 10 Millennials (58%) reported to have first found the home they eventually bought on a mobile device.

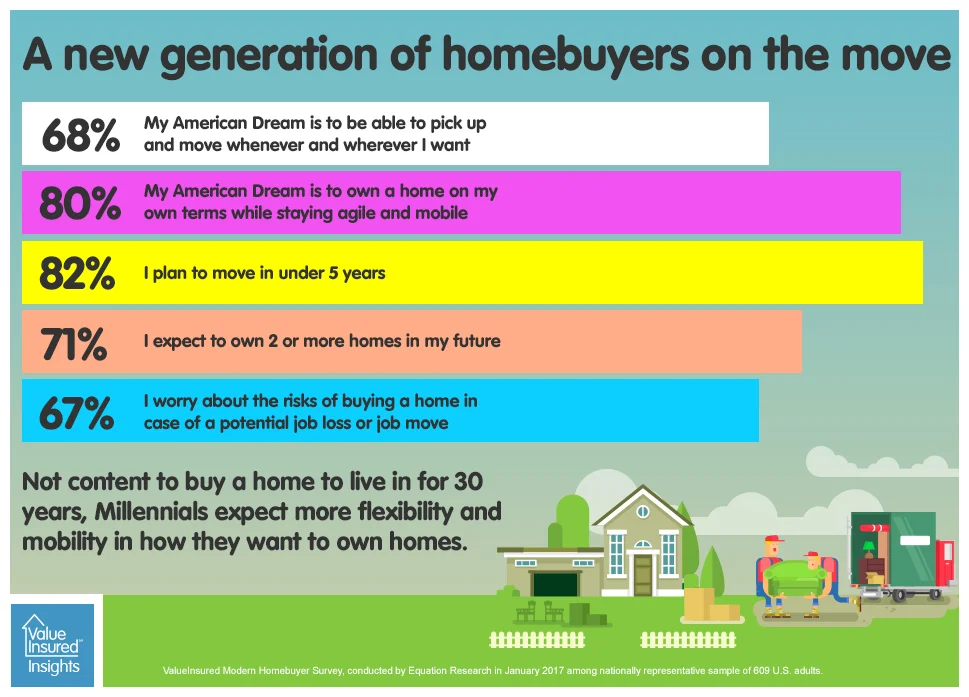

Millennials also live and plan to own their homes differently than their parents. The average Millennial job tenure is 2.8 years. They make up 43% of all movers. But, many young people have moved throughout history. Do Millennials plan to settle down once they buy a home? One can expect they should, but they aren’t likely to own the same home for 30+ years as many in their previous generations do. According to the ValueInsured Survey, while “owning my own home” remains – just like for their parents – the top personal definition of the American Dream for Millennials, two other popular answers are “having the freedom to pursue opportunities wherever they are” and “being able to move and live wherever I want”.

Other latest findings that indicate Millennials may be a generation on the move include..