Is it fair to call the millennial generation one of the least independent generations we have had? We may get some pushback for suggesting that, but speaking strictly about housing arrangement, that categorization is not exactly inaccurate.

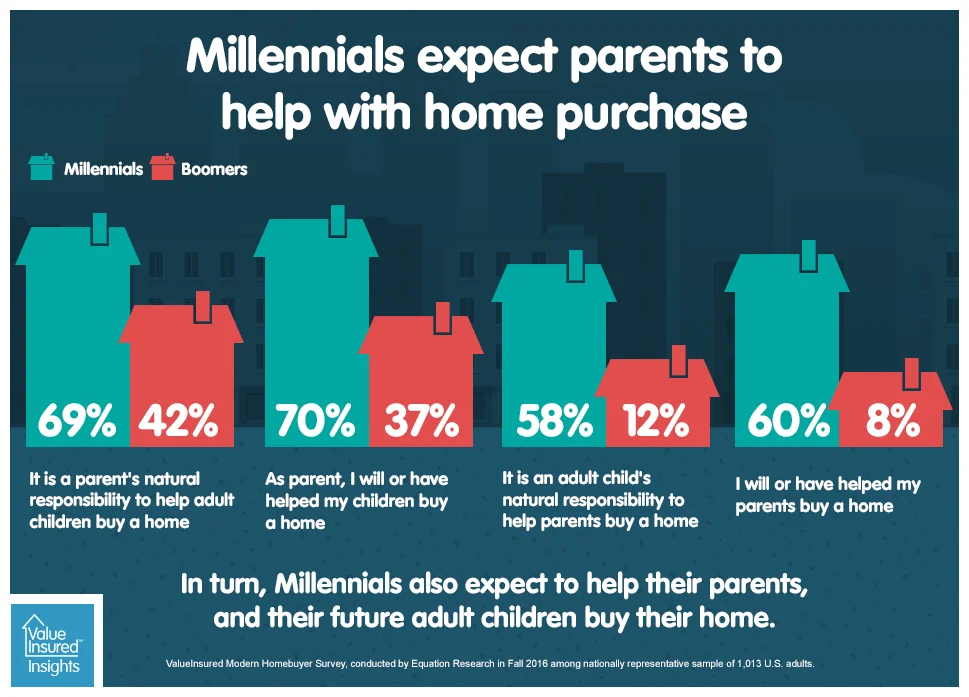

Demographic and living arrangement research from the Pew Center suggests the incidents of young adults 18-34 living at home with parents are the highest in 130 years (!). There are also recent evidence that when young adults leave home to set up their own nest, they often do so with the financial help of mom and dad.

In a latest Q4 2018 survey by ValueInsured, millennial homebuyers who plan to buy a home “in the near future” were asked if they expect financial help from their parents and/or their in-laws to fund the down payment, typically the largest financial prerequisite and barrier to owning a home. Overall, 56% of all millennial expectant buyers reported they do not expect financial help, while over 4 in 10 millennial buyers (44%) said they do.