There has been a lot of good news in the housing industry lately that Millennials are finally ready to settle down and buy homes. Dubbed the “Millennial Housing Movement”, many analysts expect Millennials will be the ultimate high gear that propels the next housing boom. Here's some recent coverage: Business Insider, Forbes, and Market Watch.

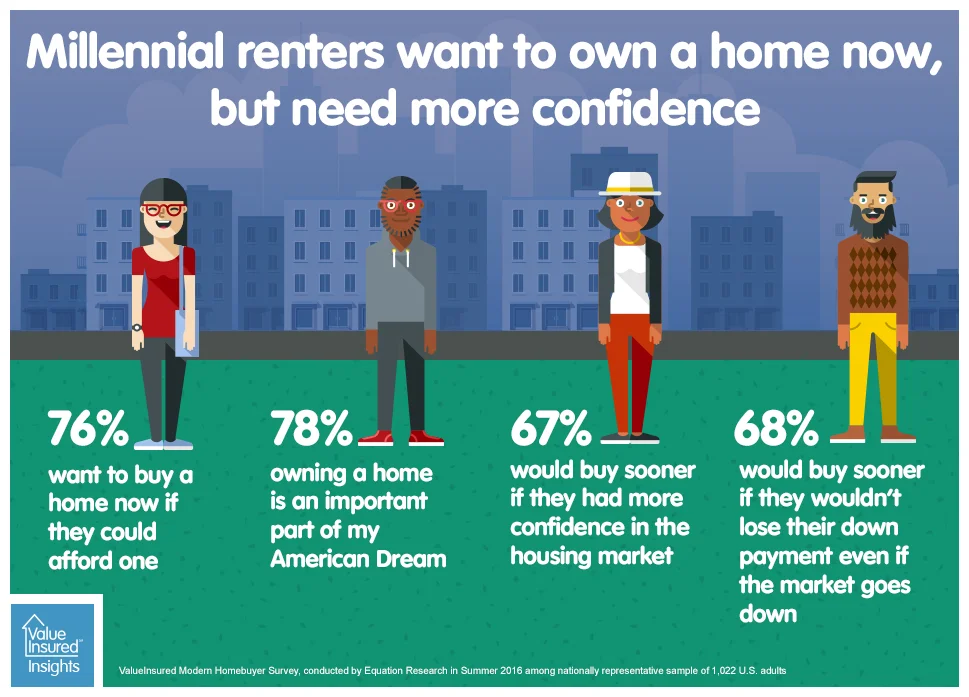

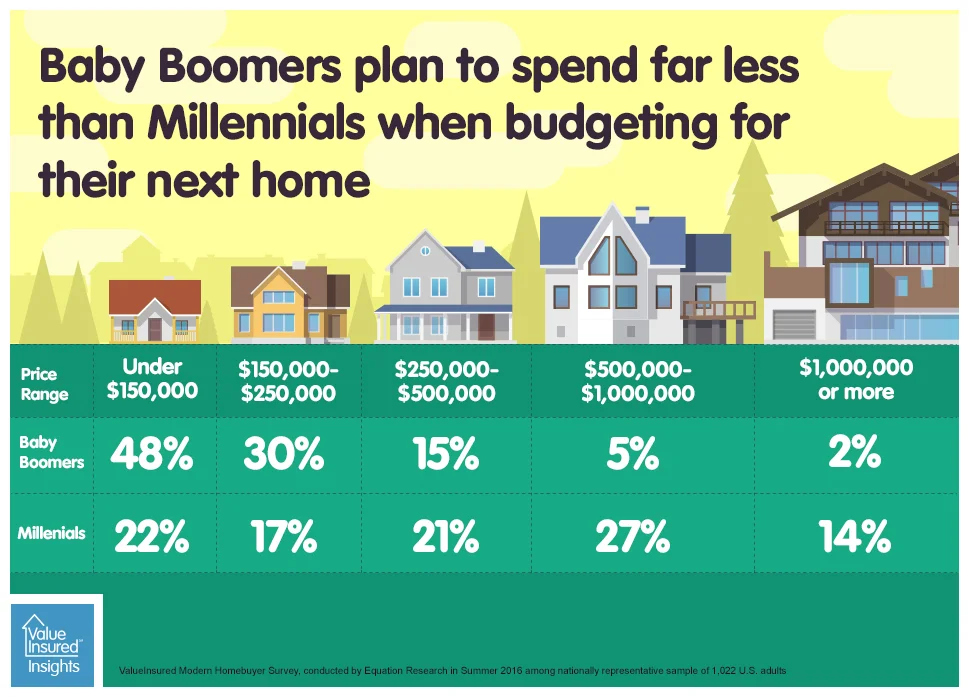

Millennials have always been the media and business darling not only because our nation has always been youth-obsessed. They are the largest population group at 75.4 million according to the latest Census Bureau, and one quarter of our country’s population. But here’s a well-document problem for Millennials: they tend to be saddled with college debt and are expected to earn less than their parents. This is a key reason – not their rumored fear of commitment – that Millennials have been late to get married, start a family, and to buy their first home.

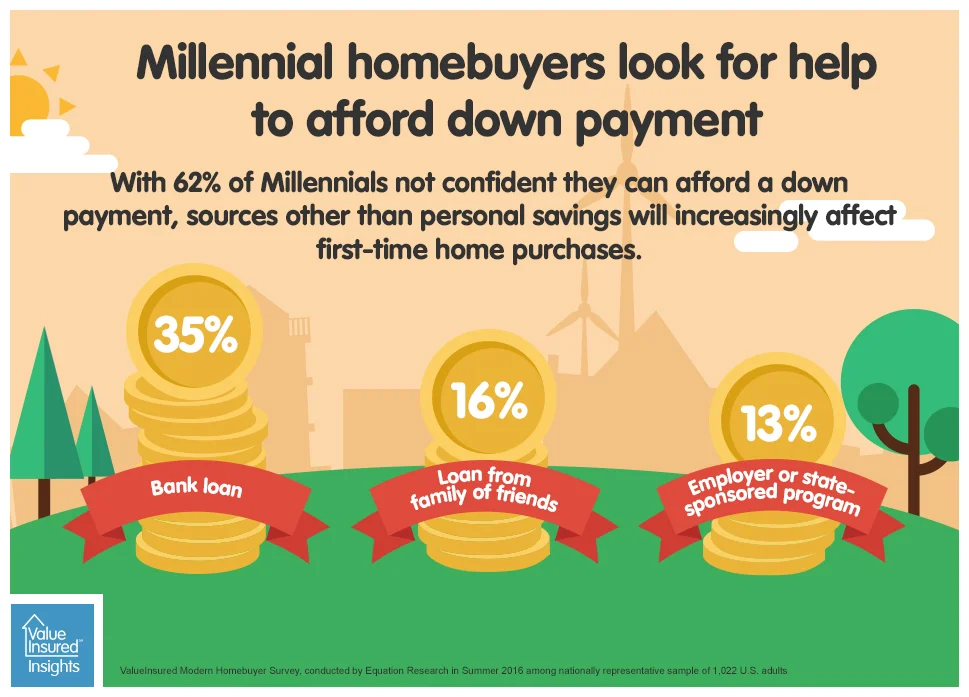

From our latest ValueInsured Modern Homebuyer Survey, we learned again, as we did in all our previous quarterly surveys, that Millennials want to own homes.