Last week, ATTOM data Solutions, curator of the nation’s largest multi-sourced property database, reported that nearly 1 in 4 (22.8%) of all purchase loan originations in our country now require a co-borrower(s)’ credit to afford the loan approved. Co-borrowers are multiple, non-married borrowers listed on the mortgage. In some of the nation’s top real estate markets – which are coincidentally some of the most expensive with rapidly rising home prices – co-borrower rates are eye-popping: half of all new home loans in San Jose now needs a co-borrower’s credit to satisfy the loan requirement (51%), nearly half in Miami (45%), 39% in Seattle, 31% in Los Angeles and 29% in San Diego.

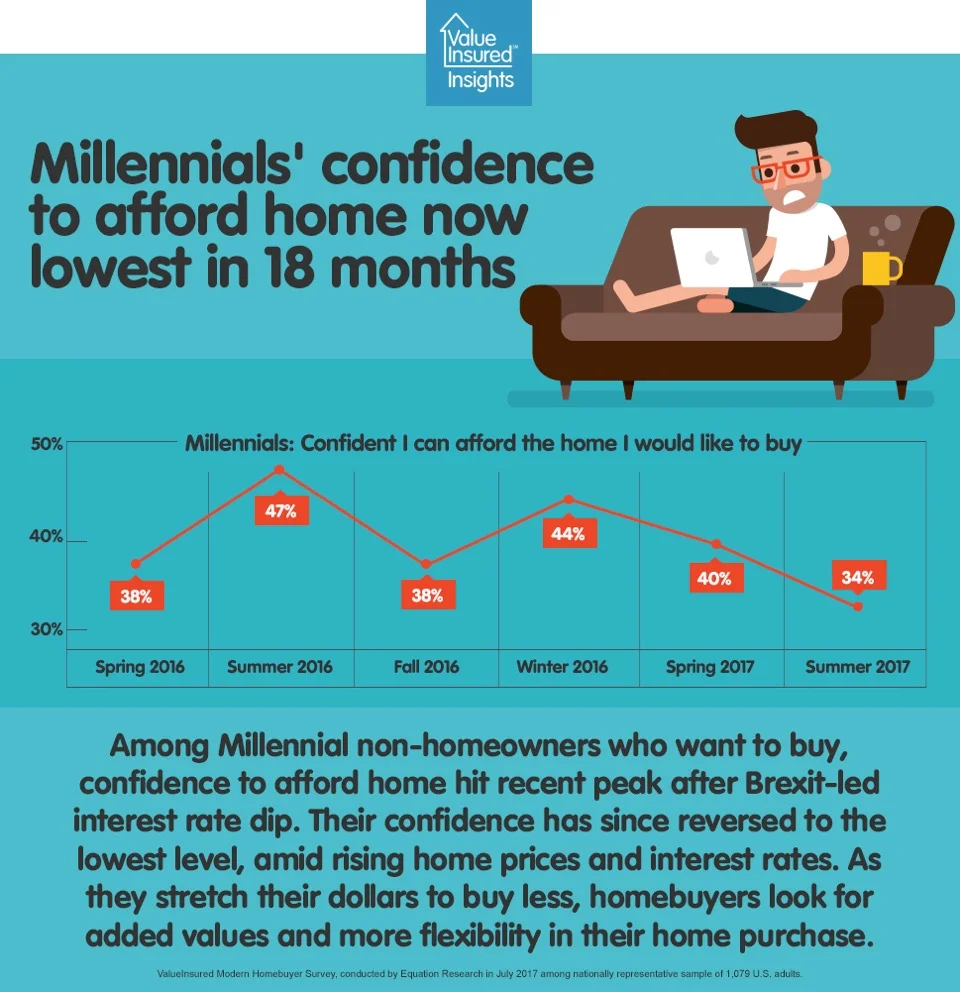

It begs the question: can these new homebuyers actually afford the homes they buy?