In January 2017, ValueInsured released its latest Housing Confidence Index that reported a slight decline in Americans’ overall housing confidence. The drop was driven by existing homeowners, who are not as confident now as they were in Fall 2016 that their home would be worth as much as what they paid for. This makes sense, since ValueInsured’s fall index was reported in early September, some of the country’s most overheated markets have stabilized and there were steady reports of cooling home prices throughout the remainder of 2016. This was partly driven by the fall 2016 interest rates hike, election uncertainty, and by buyers’ pricing fatigue.

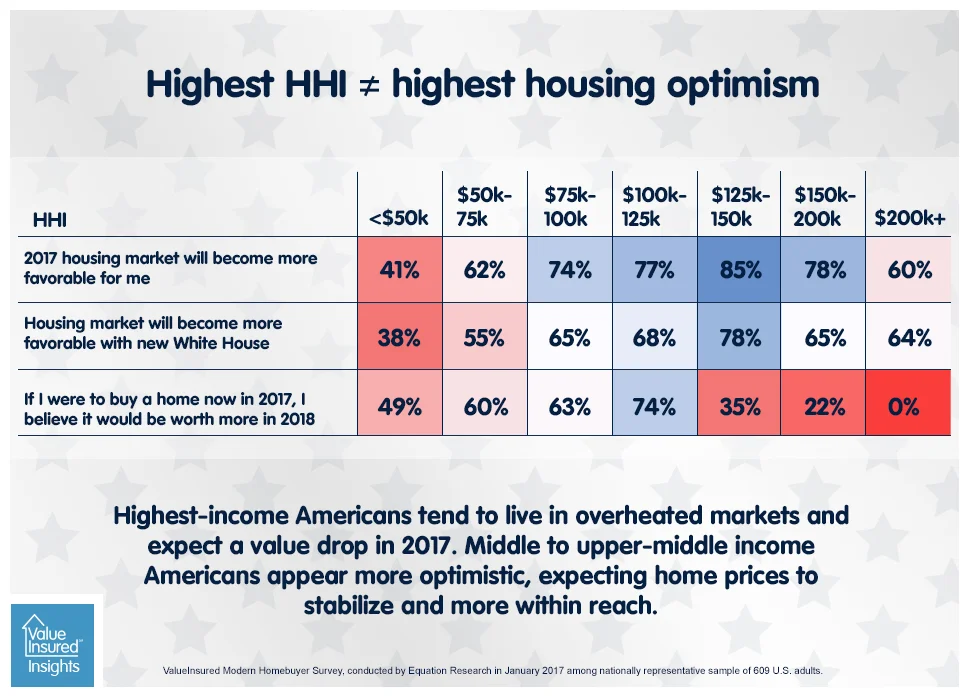

Dissecting the January Modern Homebuyer Survey data further, what’s particularly interesting is that more affluent American households – typically more confident in housing given their stronger purchasing power – are not reporting the highest housing confidence