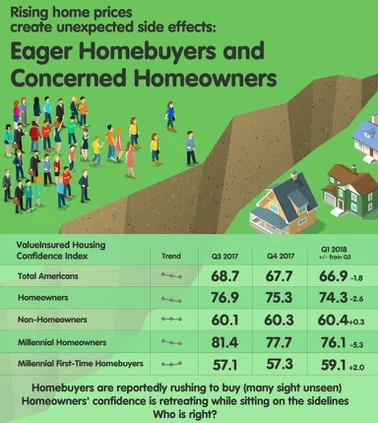

Confidence Among Homeowners, Homebuyers on Diverging Paths

DALLAS, March 6, 2018 – On the heels of the most recent Case-Shiller report, which again showed home prices on an upswing, ValueInsured’s latest quarterly Modern Homebuyer Survey finds that confidence among current American homeowners has decreased for two consecutive quarters and is starkly juxtaposed by an increase in new homebuyer confidence.

Winter 2018 ValueInsured Modern Homebuyer Survey results next week

On the heels of the latest Case-Shiller report which once again showed home prices on an upswing, our latest housing sentiment survey - the quarterly ValueInsured Modern Homebuyer Survey - indicates homeowners’ and homebuyers’ housing confidence are trending in opposite directions, but the patterns may surprise many.

The M Report: Will Rising Mortgage Rates Ruin the Homebuying Season?

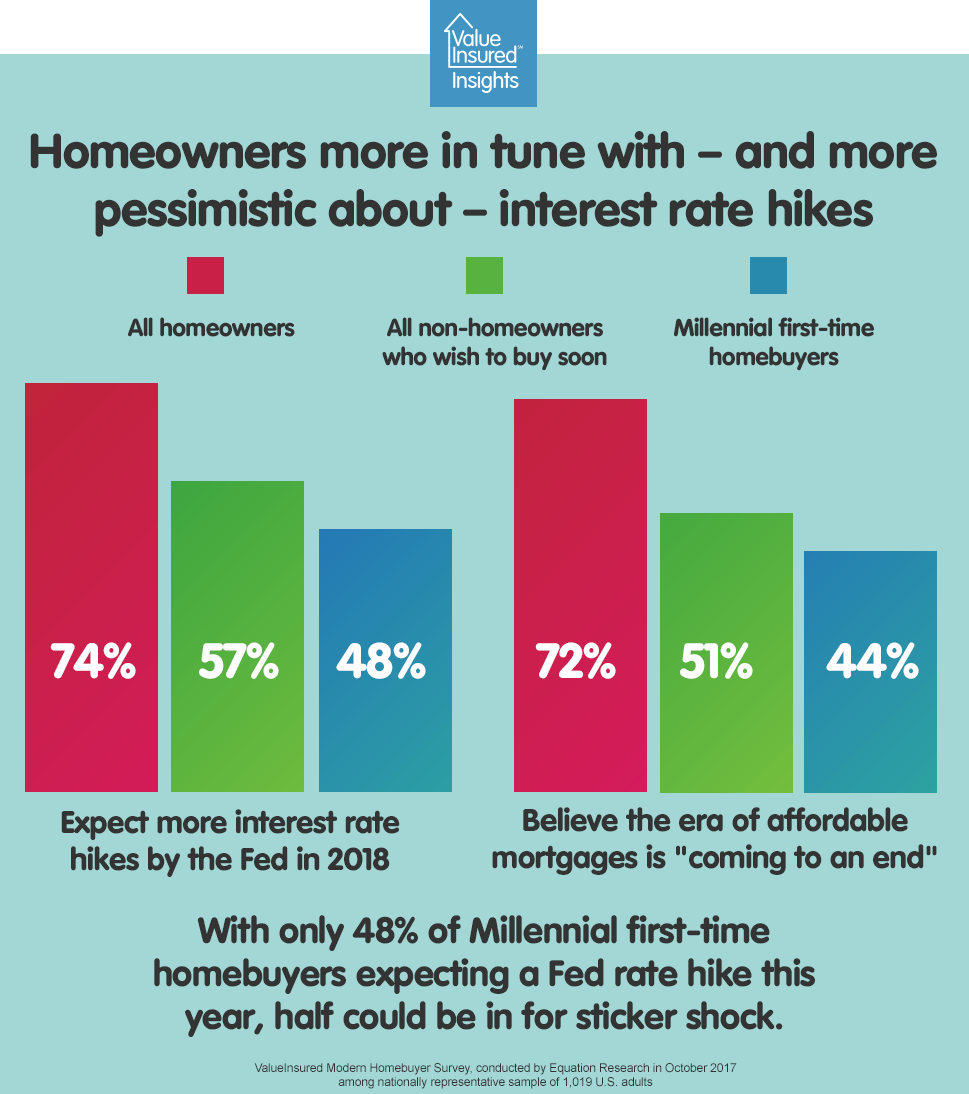

Most homeowners believe that low mortgage rates are a thing of the past. The ValueInsured survey indicated that 72 percent of existing homeowners believed the era of historically low rates and affordable mortgages was coming to an end. This sentiment was particularly acute among homeowners of expensive homes, with 95 percent of those who reported owning a home valued at $1 million or more expecting the end of low mortgage rates in their lifetime.

AJC - Atlanta home prices up 5.4 percent, raising affordability concerns

Evergreen Home Loans Launches Evergreen +Plus Down Payment Protection

Homeowners more in tune with – and more pessimistic about – interest rate hikes vs. buyers

The general consensus is that interest rates are going up this year - perhaps quite a bit. Interestingly, this appears to be something existing homeowners are a lot more in tune with. One would think homeowner hopefuls – Americans who are in the market for a home and desire to buy in the near future – would also be more aware of upcoming rate increases, after all it could have certain implications on their budget and buying timeline. However, according to ValueInsured’s latest quarterly Modern Homebuyer Survey, non-homeowners who wish to buy in the next three year report to have a lower awareness of upcoming rate hikes, or they are more optimistic that a rate hike way not happen.