More first-time buyers confident homeownership is within reach in 2017

In the past two years, as the economy improved and home mortgage interest rates stayed in record lows, one key factor that had kept housing growth from kicking up to the next gear was the stagnation of entrance by Millennial first-time homebuyers. American homeownership rate in 2016 was lowest in five decades. The primary cause was attributed to Millennials – an age group that traditionally supplied a steady stream of first-time homebuyers – whose homeownership rate dropped to the lowest recorded at 34.1%. Well-documented explanations for this historically low rate include heavy student-loan debts, growing trend to boomerang back to parents’ homes, delay of marriage, increased career mobility and other factors that delay homeownership.

However, Millennials have not lost their desire to own a home...

In First 2017 Survey Released Post-Inauguration, Americans Cautiously Optimistic in Housing Market

Optimism Driven by First-Time Homebuyers Reports ValueInsured’s Quarterly Index

DALLAS, January 25, 2017 – Americans are starting off 2017 cautiously optimistic about the housing market, reports ValueInsured Modern Homebuyer Survey. The first consumer confidence survey conducted in January and released post-inauguration reveals nearly seven-in-10 Americans (69 percent) believe 2017 will be a better year for the housing market than 2016, despite rising interest rates and a new administration.

Shoppers say will buy a home sooner with down payment protection

In our latest ValueInsured Modern Homebuyer Survey, we learned that most prospective first-time and upgrade homebuyers will buy sooner, if they could be given more confidence about the housing market, and about their odds of preserving their down payment savings. We interviewed 1,013 Americans who were interested in buying a home, and this is what they told us

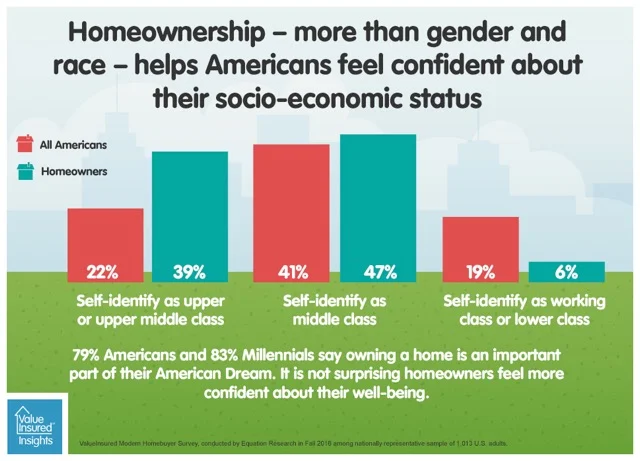

Homeownership - more than gender and race - help Americans feel confident

In a recent interview with CNBC regarding the current housing market and homeownership rate, a self-made millionaire and published financial author made the claim that an average homeowner in American today is 38 times wealthier than the average renter. This has what many often call the American Dream – if you have made it in this greatest country in the world, you get to own a piece of its land.

But in recent years, since the housing crisis, this notion has been challenged, and some of the people who have fared most poorly and had the toughest time surviving the financial crisis were Americans who owned homes in 2007-2008. We wanted to know how today’s Americans feel about their wellbeing and how it relates to homeownership, and designed part of our latest ValueInsured Modern Homebuyer Survey to explore exactly that.

HousingWire - Here are 5 bold predictions for housing in 2017 .... Plus, a bonus

As originally appeared in HousingWire

At this time last year, I predicted 2016 would be a good year to buy a home. It appears millions of Americans agreed with me. Total home sales were up 5% in the first half of 2016, and the total annual growth is expected to cap off at 4.7%. Most encouraging is the record 34% first-time homebuyers in Q3 2016, up from 29% in 2015.

For 2017, I predict a softening led by the imminent rates hikes – Fed supported or not. But there still could be opportunities for buyers and sellers alike.

ValueInsured offers innovative homebuyer-first solution to FHFA’s credit risk transfer RFI

DALLAS, Nov. 21, 2016 – ValueInsured, the only provider of down payment protection, submits a response to the Federal Housing Finance Agency’s (FHFA) Single-Family Credit Risk Transfer Request for Input (RFI). The RFI was issued to “assist FHFA and the Enterprises in their ongoing analysis of font-end credit risk transfer transaction structures in which a portion of the credit risk is transferred prior to Enterprise acquisition of the underlying mortgage.”

In its submission, ValueInsured outlined why down payment protection could be one of the most effective and far-reaching credit risk transfer (CRT) solutions, citing:

- Down payment protection (DPP) represents an additional up-front risk transfer mechanism not currently in use;

- DPP is the only upfront risk transfer mechanism designed to modify borrower behavior so as to avoid defaults;

- In contrast with other CRT mechanisms that only deal with default scenarios, DDP-related loans would be de-risked before getting onto the GSE’s balance sheets;

- For the period just prior to and during the housing crisis (1999 through 2008), DPP covered transactions would have provided approx. $2.2 billion of coverage toward borrower down payments on loans that ultimately went into foreclosures, and an additional $37.24 billion to cover borrowers’ home equity losses;

- DPP-related loans backed by major reinsurers represent an efficient use of capital that positively impacts the cost structure of residential mortgage loans.

Millennial homeowners confident in the long term, but fear housing volatility in the near term

In each of our recent quarterly ValueInsured Modern Homebuyer Survey, Millennial homeowners have consistently proven to be the most confident consumer segment in the health of our housing market. Compared to the national housing confidence index of 68.9 recorded in September 2016, Millennial homeowners reported an 83.0 point housing confidence in the same index, higher even than the 78.1 recorded for all American homeowners. Millennial homeowners also show remarkable confidence in their own long-term well-being as homeowners, with 90% agreeing “the housing market is headed to a good direction long-term for people like me”, compared to just 38% of their non home-owning peers who say the same.

However, upon further digging into our latest fall survey data, Millennial homeowners do show some cracks in their robust housing confidence.