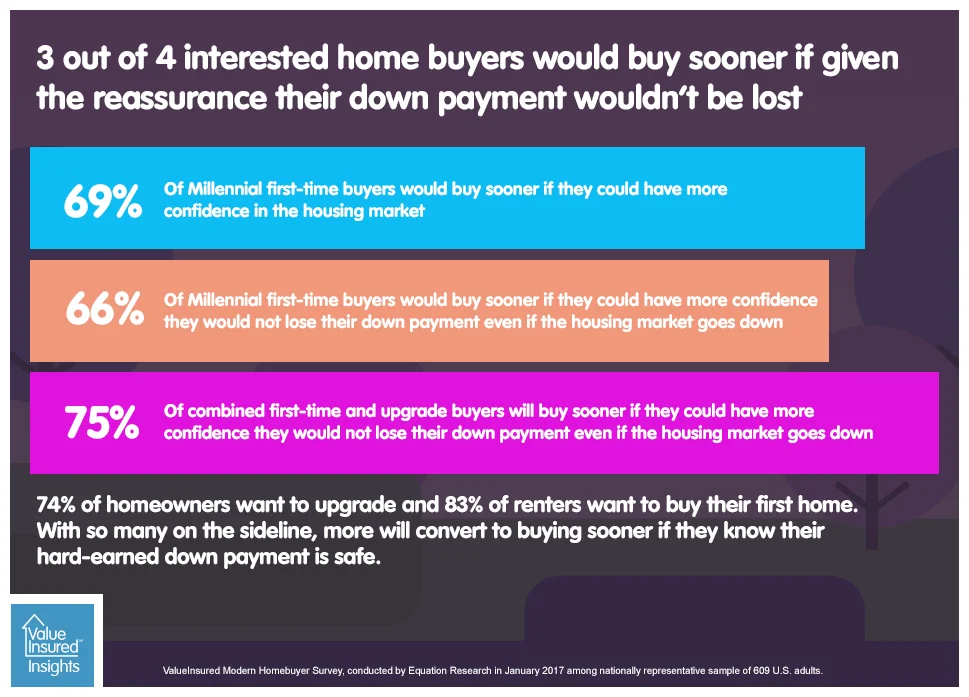

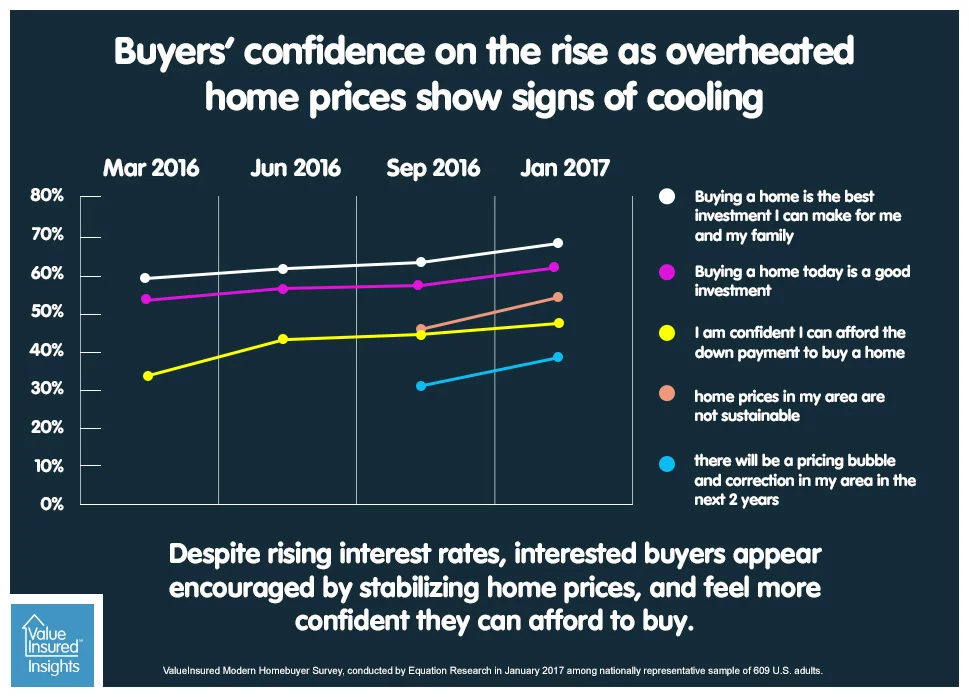

This may be what the gold rush felt like, except it is now a rush to buy homes. We keep hearing housing demand is high, inventory is tight. Some headlines even describe homebuyers as "panicking" to rush to buy homes, or rushing to lock in low rates. Yes, if you have been paying attention to recent reports, you may have seen the word “rush” used frequently when describing today’s home buying activities.

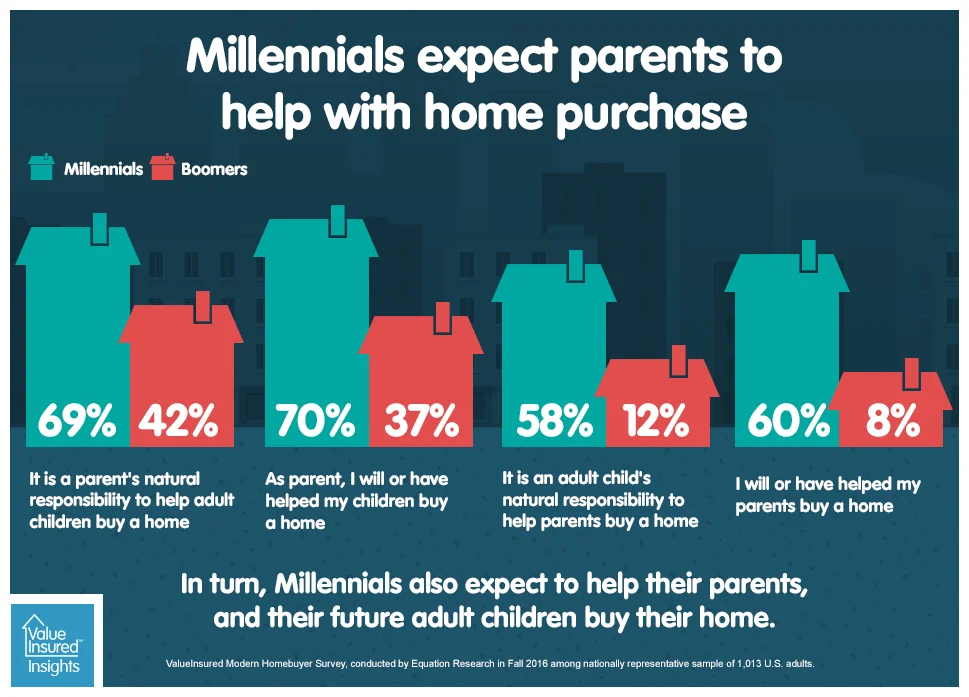

However, while many first-time home buying hopefuls wonder how they can save enough to buy at today’s sky-high prices, some may at the same time notice their own parents are selling. Baby Boomers are downsizing, and many are making bank. And they can help...