Many lenders over the past few years have found themselves caught up in a "race-to-the-bottom" where technology and the "lowest rates" were king. This is a side-effect of a booming refi market that finally appears to be drying up. So what do lenders do now?

This WSJ article details some efforts many are taking at least at a high-level. Some are scrambling with more "exotic" loans types while others are repositioning themselves to get back to a traditional purchase operation. The challenge is that the infrastructure now in place - from systems, to 3rd party lead generation, to even the types of loan officers in place - are still in the quick and easy refi mode.

Millennials question if home buying is a smart decision

Last week, the housing industry celebrated a latest NAR report that Millennials are finally making a move into housing, surpassing Baby Boomers as the largest generational segment of homebuyers, and responsible for 36% of home purchases in 2017.

But upon further inspection, and as both NAR and National Mortgage News astutely called out, Millennials are still underperforming as homebuyers to their full potential. After all, when you represent the largest population segment in the country and are in prime life stage for marriage and family formation, it is not too hard to overtake Baby Boomers, many of whom are downsizing, shifting to rentals, or moving in with their family. Homeownership rate among Americans under age 35 is currently at 36% (not to be confused with Millennials’ home purchase share, which is also 36%) according to the latest U.S. Census report. It is a substantial drop from the same age group’s homeownership rate pre-2008 housing crisis, at 43%. In other words, the housing industry has lost 1 out of every 6 under-35 homebuyers in the past decade.

The good news: Millennials’ desire to become homeowners remains high. In the latest ValueInsured Modern Homebuyer Survey, conducted in February, 77% of all American Millennials who do not currently own a home want to become homeowners, and 72% who don’t own a home believe owning is better than renting. The less good news: as home prices heat up, Millennials’ enthusiasm to buy now and their confidence in buying as a smart investment have gradually dropped over the past year.

MarketWatch - How the rollback of Obama-era financial regulations could affect you

A new banking bill won’t just impact the big banks like Chase and Wells Fargo — if it becomes law, it will impact most Americans too.

The Senate approved a bill last week that will roll back some aspects of the Dodd-Frank banking reform bill, which was passed in 2010 after the financial crisis. It will make many small and midsize banks exempt from parts of Dodd-Frank. The bill was sponsored by Mike Crapo, a Republican senator from Idaho. It will now move to the House, where it could be amended further.

Philly Mag - Survey: Millennials Aching to Buy, Homeowners Reluctant to Sell

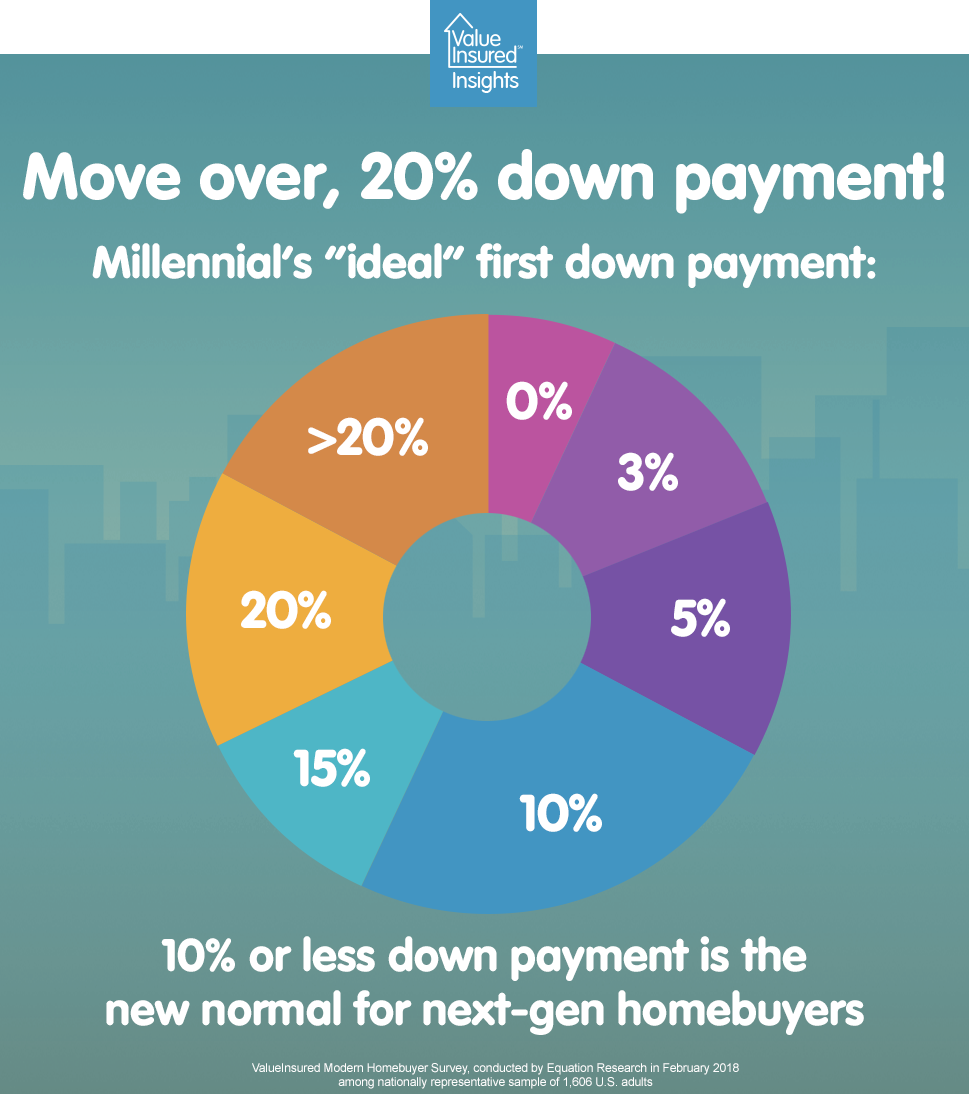

The “ideal” down payment

According to ValueInsured’s latest quarterly results, 7% of all millennials first-time homebuyers, if given the option to choose, hope to put down zero percent down; another 26% ideally wish to put down 3-5%. In other words, 1 in 3 (33%) believe their ideal down payment is up to 5%. Most cite the eagerness to buy immediately as their motive, and express an understanding that they could potentially be paying a higher interest rate and will pay higher monthly mortgage payment after having a lower down payment commitment. To 1 in 3 next-gen homebuyers, that is considered the ideal trade off.

American Financial Network, Inc. (AFN) Partners with ValueInsured to Offer Its Customers Down Payment Protection with AFN Protection+

American Financial Network, Inc. (AFN) today introduced AFN Protection+, an innovative mortgage product that protects a homebuyer’s down payment and is available immediately on all applicable AFN mortgages. AFN Protection+ will include +Plus SM down payment protection by ValueInsured SM embedded directly into homebuyers’ mortgages.